The Not So Lowly Carrot

Organic Agriculture Centre of Canada

Canadians’ love affair with “local” does not appear to be a flash in the pan infatuation. They’re committed. Buying “local” or, more broadly, “Canadian” is increasingly the consumers’ choice for a variety of goods but particularly for food. Retail pilot projects and a grocery shopping simulation study recently conducted by Agriculture and Agri-food Canada indicate that while Canadian consumers claim that price is a key factor in their purchase decisions, their purchases are actually more influenced by brand and Canadian origin labeling than price.

This is good news for Canadian Organic producers who are ideally positioned to benefit from the “Buy local/Buy Canadian” aspirations of consumers by providing environmentally sustainable, nutritious, great tasting foods that support local communities.

The organic food sector is the fastest growing segment of the Canadian food industry with an annual growth rate of 15 – 20%. In 2008, retail food sales were estimated at $2 billion, representing 2.5% of total food retail sales in Canada. However, according to a 2007 report by Holmes and Macey, approximately 80% of organic foods sold in Canada are imported, predominately from the United States.

The Canada Organic Growers Annual Survey reported 3914 certified organic producers and 695,463 hectares in organic production in 2009. Despite a year over year increase in organic acreage and number of organic farmers, organic agriculture accounts for only 1% of total agricultural land under production in Canada, representing a tremendous opportunity for growth and for import replacement. Nowhere is this more evident than in the production of organic carrots which can be grown in every province in Canada, sold into the fresh market immediately after harvest or stored for 7 – 9 months to be sold throughout the winter months. Organic producers grow early, main crop, and late maturing carrot varieties, and pack in assorted formats to serve the various needs of the marketplace – from bunched carrots with leafy tops to packaged baby peeled carrots for immediate consumption, to topped table and juicer carrots which are packed in consumer packs or bulk bales and sold fresh after harvest or stored for several months. From the exotic purples to the sweet, crunchy and familiar orange-coloured varieties, organic carrots are anything but lowly.

Canada produces a lot of carrots and we also import a significant amount throughout the year, particularly from January to June before our own production is in full swing. According to production and trade data from Statistics Canada, Canada imported 105,352 metric tonnes of carrots (organic and non-organic) representing 21% of all carrots sold in Canada for the fresh and processing markets in 2010. Organic carrots accounted for 16% (16,560 metric tonnes) of imported carrots. However, Canada imported over 1000% more metric tonnes of organic carrots than it produced in 2010, which is estimated at 1,634 metric tonnes. Similar percentages were calculated for 2009 and 2008.

Table 1 provides import data on the three categories of organic carrots tracked by Statistics Canada using Harmonized Series (HS) Import Codes. While the large quantities of imported organic carrots represent significant import replacement opportunities for Canadian producers, it is important to keep in mind that Canadian organic farmers market mainly bunched carrots, cello-packed and bulk table and juicer carrots, not packaged baby carrots. However, since the baby carrot categories account for 50 - 55% of the volume of imported organic carrots, baby carrots represent interesting import replacement opportunities for Canadian organic producers who have value-added capabilities.

Table 1. Import Totals for All Organic Carrot Categories

January to January Import Totals

Carrots, certified organic, fresh or chilled - Canada's Imports from All Countries

Source: Statistics Canada

| HS Code | Description | Quantity (kg) | |||

|---|---|---|---|---|---|

| 2007 | 2008 | 2009 | 2010 | ||

| HS:0706.104010 | Carrots ( in bulk or packed; not baby) | 6,536,380 | 8,154,918 | 8,214,022 | 7,367,350 |

| HS:0706.102011* | Baby carrots, in bulk or pack of a weight <=1 kg | 2,057,706 | 3,409,010 | 2,191,669 | |

| HS:0706.102012* | Baby carrots, in bulk or pack of a weight >1 kg | 1,996,369 | 3,829,447 | 7,001,167 ** |

|

| TOTAL | 6,536,380 | 12,208,993 | 15,452,479 | 16,560,186 | |

*code implemented in July 2008 **7,001,167 kg is highly unusual in comparison to the 3,319,464 kg of conventional baby carrots in bulk pack or weight > 1kg that were imported in 2010. The figure may be inflated due to input error by customs agents. |

|||||

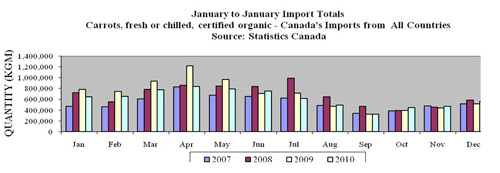

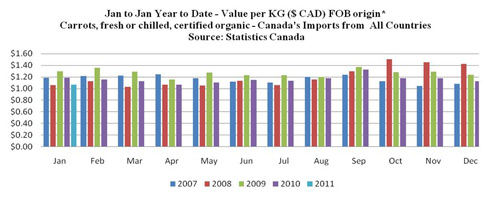

Figure 1 provides monthly import volumes of “regular” carrots (not baby) from 2007 – 2010 followed by Figure 2 which provides average monthly $Value per kilogram for “regular” carrots in 2010. This information is valuable in that it indicates that imported volumes are high and prices are high from December to May, thereby offering a sound opportunity for import replacement.

Figure 1. Organic Carrots - Monthly Import Totals

Figure 2. Imported Organic Carrots - $ Value per kg

*FOB origin pricing does not include transportation or storage costs. To estimate wholesale selling prices from this data, add a 25 – 35% wholesale margin.

Organic producers are encouraged to use the data from Statistics Canada and Canada Organic Growers when planning for production, storage, and marketing. Distributors too are a wealth of information for they will provide historical and real time price data to growers and provide counsel on optimal selling time. Distributors who are committed to supporting Canadian organic producers will also take a lower margin on Canadian product, minimizing the price difference between imported and Canadian grown produce to help move local product through retail channels.

References:

Agriculture and Agri-Food Canada, 2010. Canadian Grocery Shopping Simulation Study, March 2010. Accessed March 2011

Agriculture and Agri-Food Canada, 2008. The Canadian Organic Sector, Trade Data and Retail Sales (2008)

Holmes, M. and Macey, A, 2007. Canada’s Organic Market. Accessed March 2011

Macey, Anne. 2010. Certified Organic Production in Canada 2009. Canada Organic Growers. Feb 2010. Accessed March 2011

Shore, Randy. 2011. Grocery customers eat up Eat Canadian pilot project - Ottawa testing branding program at Stong's Market in Dunbar. Vancouver Sun. January 28, 2011. Accessed March 2011

Statistics Canada, Certified Organic Commodity Harmonized Import Codes. Accessed March 2011

[To obtain import data for organic commodities tracked by Statistics Canada, submit a request to a government representative on the following website

Statistics Canada. 2011. Fruit and Vegetable Production – February 2011. Catalogue no. 22-003-X. Accessed March 2011

This article was written by Gunta Vitins on behalf of the OACC with funding provided by Canada’s Organic Science Cluster (a part of the Canadian Agri-Science Clusters Initiative of Agriculture and Agri-Food Canada's Growing Forward Policy Framework). The Organic Science Cluster is a collaborative effort led jointly by the OACC, the Organic Federation of Canada and industry partners. For more information: oacc@dal.ca or 902-893-7256.

Posted October 2011